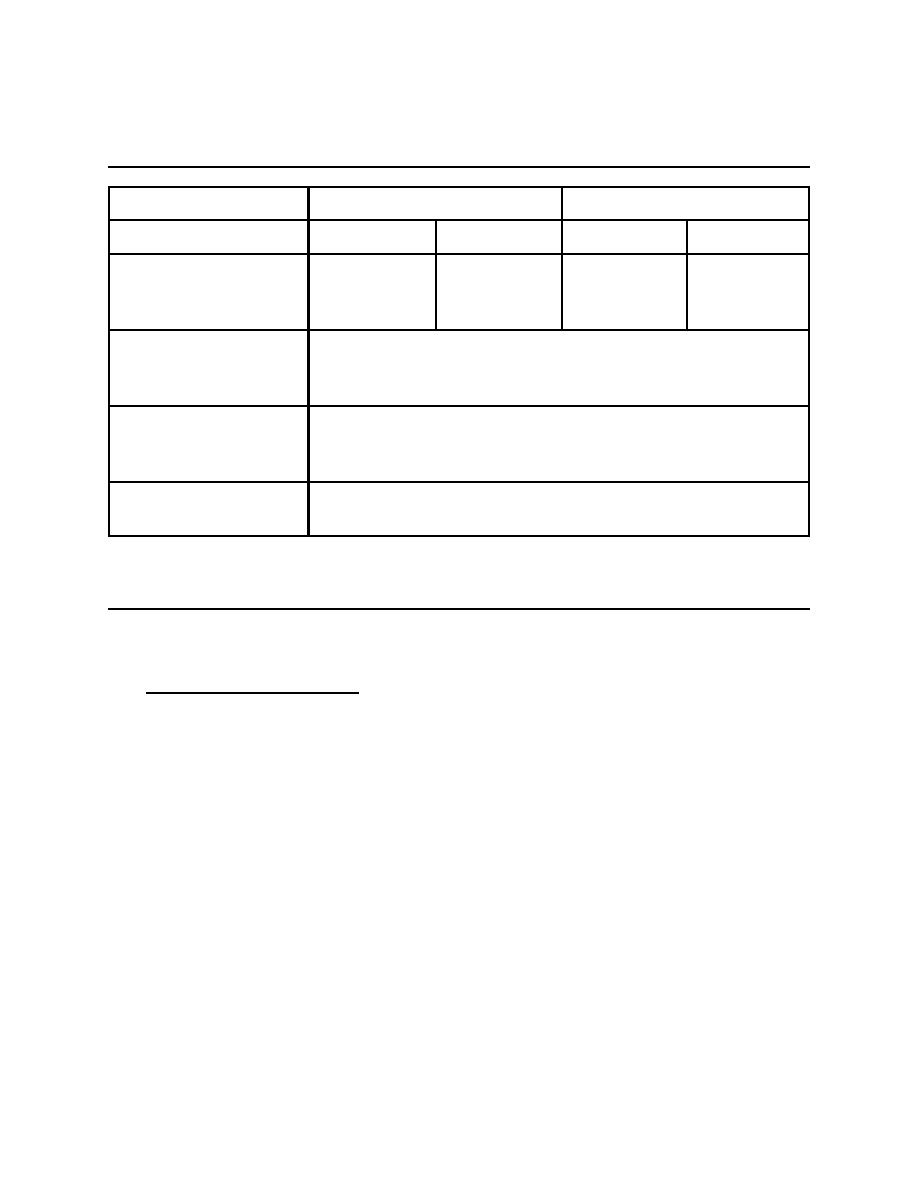

Table F-4: Immediate Rehabilitation Life-cycle Costs (Standard Errors in Parenthesis)

Unit 1

Unit 2

Reliability Cost

Turbine

Turbine

Expected Present value

of Life-cycle Repair

77,300

82,100

77,300

82,100

Costs

(3,700)

(2,600)

(3,700)

(2.600)

Expected Present value

of Life-cycle

1,450,800

Opportunity Costs

(30,400)

Expected Present value

of Life-cycle O&M

179,000

Costs

(450)

Total Life-cycle Costs

1,948,600

(31,069)

Values in dollars.

F-4. Major Rehabilitation Strategy.

a. For the purposes of this example, only one rehabilitation strategy is considered,

immediate rehabilitation of the turbines and generators in both units. In addition, construction

activities are initiated immediately to rehabilitate Unit 1. After 2 years, Unit 1 construction and

testing will be complete and Unit 2 will be rehabilitated. Both units will be available for service at

the end of the fourth year. Table F-1 lists the revisions in risks and costs due to the

rehabilitation. During the construction, only one unit is in operation so that the opportunity costs

shown in Table F-2 are incurred. Additionally, no regular O&M expenditures take place for a unit

that is out of service whether under repair or during rehabilitation construction. Table F-4 shows

the reliability costs with this rehabilitation strategy. Note that the opportunity costs with

rehabilitation, due to lost energy and capacity, exceed those that would have occurred without

rehabilitation. This stems from the fact that during the rehabilitation construction (4 years), one

of the units is out with certainty. Therefore, there is this certain loss plus the increased risk that

both units will be out during the construction. After rehabilitation the risk of an outage is greatly

reduced but the contribution to reducing the life-cycle present value is also less important due to

discounting.

b. From the results from Tables F-3 and F-4, the expected present value of benefits from

the proposed rehabilitation strategy are the difference in life-cycle costs. The summary statistics

F-6

Previous Page

Previous Page