EP 1130-2-500

27 Dec 96

units out simultaneously since all units are typically not in operation simultaneously even when all

are available. Values assumed for this example are shown in Table F-2.

f. Since the repair costs and opportunity costs can occur in future years, the analysis

requires discounting the costs in each year to the base year. A discount rate of 8.5% is used in

this example. The current year Federal discount rate should be used in an actual evaluation,

(8.00% in FY94).

g. The evaluation problem is modeling the possible pathways or sequences of

performance that each component for each unit can take, including resetting of the risk after

failure of a component. In addition, the

model must be flexible to deal with

situations with multiple power units and

multiple components. The model must

account for:

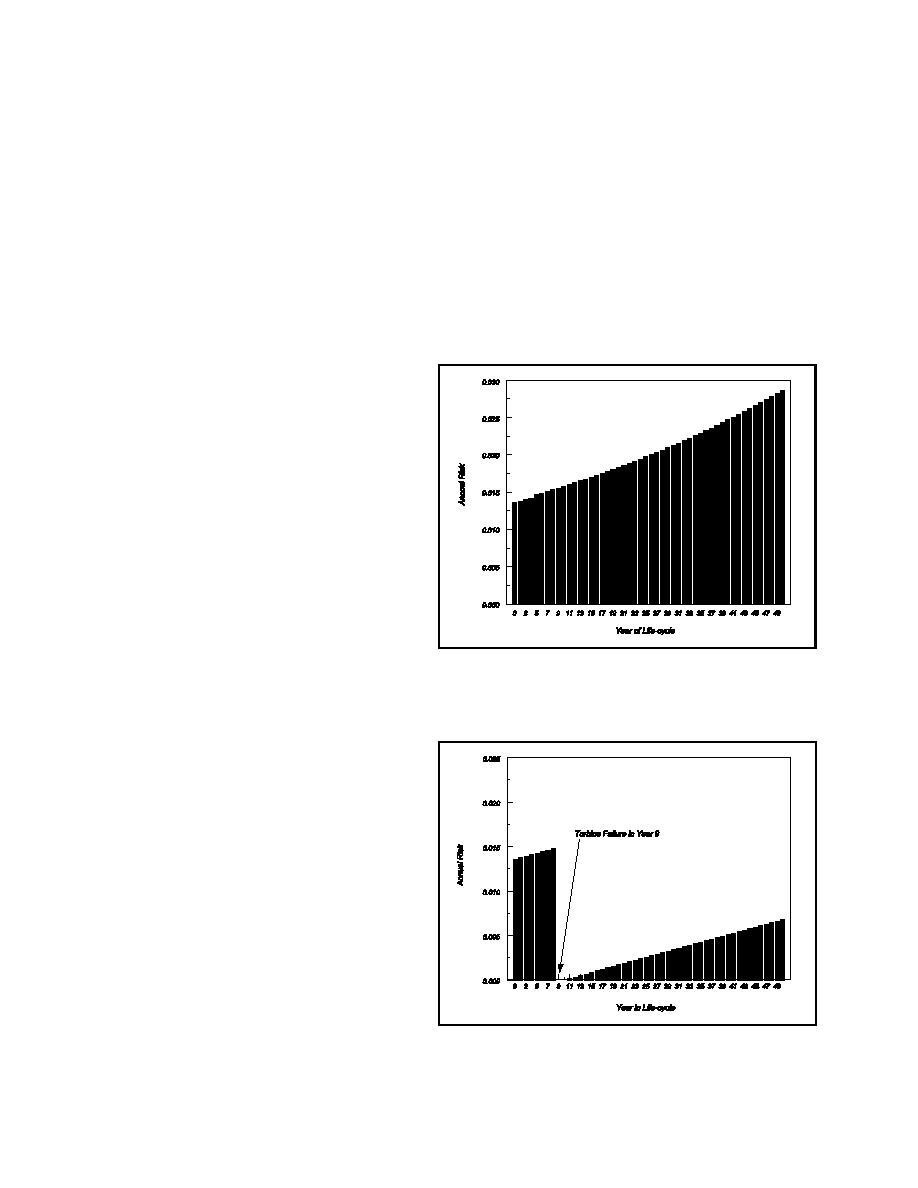

(1) the change in reliability of a

component (increases in risk) over

time from the start of the analysis,

(2) the changed reliability of a

repaired component, (see Figure F-

3),

(3) the possible change in

degradation rate of the repaired

component,

Figure F-2: Non-linear Risk Function

(4) the present value of component

repair costs when a component

fails,

(5) the present value of foregone

project outputs (energy and

capacity) when some units are out

of service due to component

unsatisfactory performance,

(6) the time necessary to repair

components,

(7) the present value of regular

O&M costs while repairs are

undertaken, and

(8) the present value of regular

O&M costs after repairs are made.

h. Once these values are

determined, they can be used in a risk-

Figure F-3: Life-cycle Risk with One Repair

F-3

Previous Page

Previous Page