EP 1110-1-8

(Vol. 1)

31 July 03

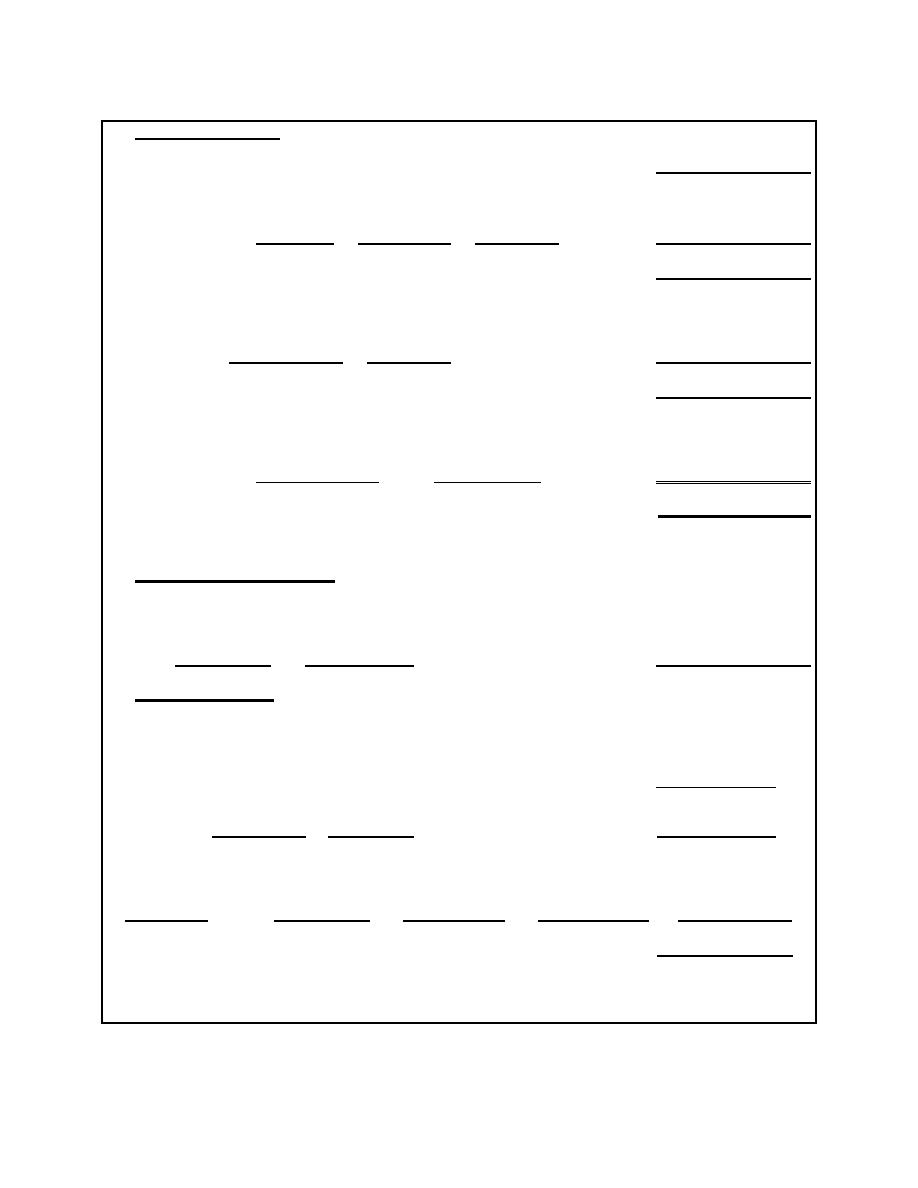

2. EQUIPMENT VALUE

a.

List Price + Accessories: [at Year of Manufacture]

=$

Discount: (List Price + Accessories) x (Discount Code)

(1)

[1.c.(3)]

($

+$

)x(

)

=-($

(2)

Subtotal [2.a.] [2.a.(1)]

Subtotal=$

(Subtotal) x (Tax Rate)

(3)

Sales or Import Tax:

[2.a.(2)]

[Appendix B]

($

)x(

)

=+$

(4)

Total Discounted Price: Subtotal: [2.a.(2)] + [2.a.(3)]

Subtotal=$

(Shipping Weight) x (Freight Rate per cwt)

b.

Freight:

[1.a.(8)]

[Appendix B]

(

cwt) x ($

/cwt)

=+$

c.

TOTAL EQUIPOMENT VALUE (TEV):

TOTAL[2.]:=$

[(2.a.(4)] + [(2.b)]

(See chapter 3 for used and overage equipment rate adjustments.)

3. DEPRECIATION PERIOD (N)

(LIFE hours (hr)) / (Working Hours Per Year (WHPY)) = N

a.

[1.c.(4)]

[Appendix B]

(

hr) / (

hr/yr)

=

4. OWNERSHIP COST

a.

Depreciation

(1)

Tire Cost Index (TCI):

(Tire Index, Yr of Mfg) / (Tire Index, Based on 1.a.(3))

=

Tire Cost Index (TCI)

[Appendix E, EK=100]

[Appendix E, EK=100]

(

)/(

)

=

(TCI)

[(TEV)

x [1.0 - ( SLV )] - [ ( TCI ) x (Tire Cost)]] / ( LIFE )

(2)

[2.c.]

[1.c.(5)]

[4.a.(1)]

[1.a.(9)(d)]

[1.c.(4)]

[($

) x [1.0 (

)] [(

) x ($

)]] / (

hr)

/hr

=$

Page 2 of 6

Equipment Rate Computation Worksheet (copy as needed).

A-9

Previous Page

Previous Page